In Jan. 2016, China's R32 market was languished, a continuation of the full-year downturn in 2015. Though the downstream air-conditioning enterprises begin to increase input in R&D of R32 air conditioner, it, impacted by severe overcapacity, makes little results. CCM predicts that in 2016, the R32 market will not make a recovery, and instead, will fluctuate following cost.

In Jan. 2016, China’s difluoromethane (R32) market stayed sluggish, with deserted business trading. Accordingly, the downstream purchased R32 based on demand, as it was in slack season. In addition, the sales pressure of R410a (a 1:1 mixture of R32 and pentafluoroethane – R125) was fairly heavy, further decreasing the demand for R32.

Under this, producers only maintained low operating rates. The price of dichloromethane (DCM, main raw material) rose slightly and stayed low, showing limited support to R32. By 21 Jan., the average ex-works price of R32 was USD1,740/t (RMB11,313/t), down by 3.39% over that of USD1,801/t (RMB11,712/t) in Dec. 2015.

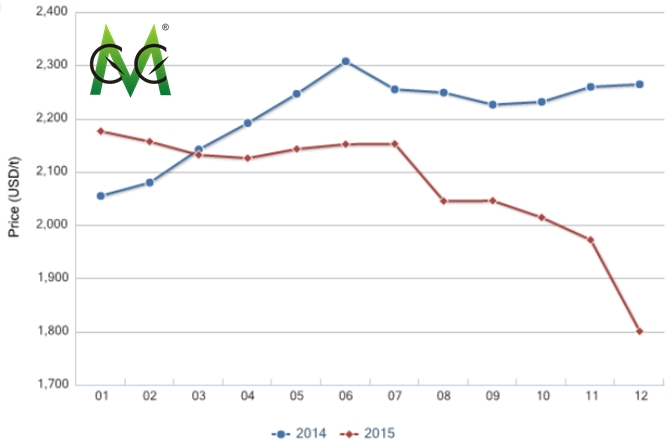

This was a continuation of the downturn in 2015: by 17.23% throughout the year.

It is notable that the production capacity of R32 was expanded constantly, in spite of falling prices. According to CCM’s research, the figure totalled 260,000 t/a in 2015, up by 8.33% over that of 240,000 t/a in 2014. Specifically, the production capacity in Shandong Province headed the list, by about 110,000 t/a (= 42.31% of the national figure), of which Shandong Dongyue Chemical Co., Ltd. ranked first, by 28,000 t/a.

This is mainly because such R32 producers hold positive attitude towards the future development.

As the substitution of difluorochloromethane (R22) in downstream industries is accelerated, R32 as a substitute, has received support from the Chinese government, clearly and definitely in the 1st list of recommended substitutes. Many domestic air conditioner manufacturers in succession have increased the production of R32 air conditioner.

For instance, Gree Electric Appliances, Inc. of Zhuhai has officially launched its R32 air conditioner, saying that it would increase investment into producing this product. Haier Electronics Group Co., Ltd. and Midea Group Co., Ltd., following the trend, are developing R32 air conditioners.

In addition, the maintenance and repair industry also begins to stock up R32, expected to increase the demand.

In fact, the domestic R32 industry now is trapped in severe overcapacity, whilst the R32 air conditioner business is at a primary stage, indicating a very small positive effect. CCM predicts that in 2016, it is hard for the R32 market to make a rebound, and instead, it will fluctuate based on cost.

Specifically, the consumption of R32 was only about 90,000 tonnes in 2015. In 2016, the application quota for R22 in the air conditioning industry is down by 6,493 tonnes YoY. However, another substitute, propane (R290) will also take the shares. Hence, the growth in demand will make a useless attempt, compared to the total capacity of 260,000 t/a.

Besides, in Q4 2015, the inventory of air conditioners still stayed at a high level. So, in 2016, its production will not increase largely, showing weak demand for refrigerant.

In view of the R32 price trend in 2015, the price in 2016 will also fluctuate following the cost changes.

In H1 2015, the prices of raw materials, DCM and hydrogen fluoride (HF), rose by 2% and 10% separately. This pushed up the R32 price in Q2 particularly. However in H2 2015, the prices of raw materials fell continuously, by 33% (DCM) and 17% (HF), drawing back the R32 price also.

Monthly ex-works price of difluoromethane in China, 2014 & 2015

Source: CCM

If you need more information about R32 in China, why not get a free-trial of CCM’s Online Platform? You can get much more information about R32 or even the whole fluoride market for FREE!

Price of 1 report = the entire database worth millions of dollars

Direct contact with our internal experts

Fortune 500 companies designated

GET FREE TRIAL NOW!

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailingecontact@cnchemicals.com or calling +86-20-37616606.

Tag: R32